The quest for reliable Bitcoin mining hardware in America is a journey fraught with complexity, excitement, and the tantalizing prospect of digital gold. We’re not just talking about plugging in a machine and watching the BTC rain down (though, wouldn’t that be nice?). It’s about navigating a dynamic landscape of hashing power, energy consumption, and the ever-fluctuating price of Bitcoin itself. Forget get-rich-quick schemes; this is a strategic endeavor demanding meticulous planning and a deep understanding of the ecosystem.

The allure of Bitcoin mining lies in its decentralized nature, its potential for passive income (keyword: potential), and the intellectual stimulation of participating in a technological revolution. But before you dive headfirst into the digital gold rush, let’s talk hardware. The ASIC (Application-Specific Integrated Circuit) miner reigns supreme. These purpose-built machines are optimized for one task: solving the complex cryptographic puzzles that secure the Bitcoin network and earn you those coveted block rewards.

Choosing the “best” option isn’t as simple as picking the most expensive or the one with the highest hash rate. It’s a delicate balance of upfront cost, power efficiency, hashrate, and availability. Consider the Antminer series from Bitmain, often touted as industry leaders, or the Whatsminer range. Each model has its strengths and weaknesses, and their suitability depends heavily on your individual circumstances, including your energy costs and tolerance for noise (these things can be LOUD!).

Beyond the hardware itself, consider the broader infrastructure. Are you planning to mine from your garage, or are you eyeing a dedicated mining facility? Home mining presents challenges in terms of noise, heat, and power consumption. You might need to upgrade your electrical system, invest in noise dampening solutions, and carefully monitor temperatures to prevent overheating and damage to your equipment.

Many aspiring miners opt for hosting services, particularly those lacking the space, technical expertise, or desire to manage the intricacies of a mining operation. Hosting providers offer a turn-key solution, providing the infrastructure (power, cooling, security, and maintenance) in exchange for a fee. This can significantly reduce the upfront investment and operational burden, but it’s crucial to thoroughly research and vet potential providers, paying close attention to their reputation, uptime guarantees, and security protocols.

The regulatory environment surrounding Bitcoin mining is constantly evolving. Some states offer incentives for renewable energy sources, making them particularly attractive locations for mining operations. Others have stricter regulations or higher electricity costs, which can significantly impact profitability. Staying informed about the legal and regulatory landscape is crucial for long-term success.

Don’t overlook the importance of networking and community engagement. The cryptocurrency space is incredibly collaborative, and connecting with other miners can provide valuable insights, troubleshooting tips, and access to resources. Online forums, social media groups, and industry events are excellent opportunities to learn from experienced miners and stay abreast of the latest trends.

While Bitcoin dominates the headlines, consider the potential of mining other cryptocurrencies. Ethereum, while transitioning to Proof of Stake, previously relied on GPU mining. Dogecoin, Litecoin, and other altcoins offer alternative mining opportunities, albeit with different algorithms and hardware requirements. Researching the profitability and long-term viability of these alternatives is essential.

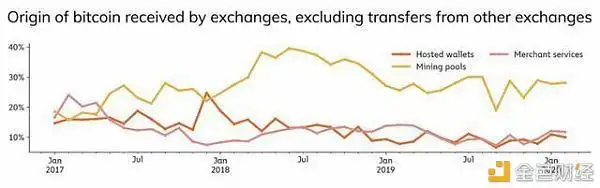

Exchanges play a critical role in the mining ecosystem. They provide the means to convert your mined cryptocurrencies into fiat currency or other digital assets. Selecting a reputable and secure exchange is paramount. Look for platforms with robust security measures, transparent fee structures, and a wide range of trading pairs.

The energy consumption of Bitcoin mining is a growing concern. As the network grows and competition intensifies, miners are constantly seeking ways to reduce their carbon footprint. Renewable energy sources, such as solar, wind, and hydro power, are becoming increasingly popular among environmentally conscious miners. Innovative cooling solutions and energy-efficient hardware are also playing a crucial role in minimizing the environmental impact of mining operations.

The volatility of Bitcoin and other cryptocurrencies is a constant source of anxiety and opportunity. Market fluctuations can significantly impact mining profitability. Developing a robust risk management strategy is essential for weathering the inevitable storms. This might involve hedging your Bitcoin holdings, diversifying your mining portfolio, or securing fixed-price electricity contracts.

Investing in reliable Bitcoin mining hardware is not just about buying a machine; it’s about investing in an ecosystem. It’s about understanding the technology, the economics, and the ever-changing landscape of the cryptocurrency world. It requires dedication, research, and a willingness to adapt to the challenges and opportunities that lie ahead. But for those who are willing to put in the work, the rewards can be substantial.

Ultimately, the “best” American option for reliable Bitcoin mining hardware is the one that aligns with your individual goals, resources, and risk tolerance. Do your homework, ask questions, and never stop learning. The world of Bitcoin mining is constantly evolving, and those who are best prepared will be the ones who reap the greatest rewards. Remember, it’s a marathon, not a sprint.

This article offers an insightful exploration of the leading American options for dependable Bitcoin mining hardware. It delves into various models and manufacturers, analyzing performance, energy efficiency, and longevity. Readers will appreciate the expert recommendations and comprehensive comparisons that make navigating this complex market approachable and informative.